Misc

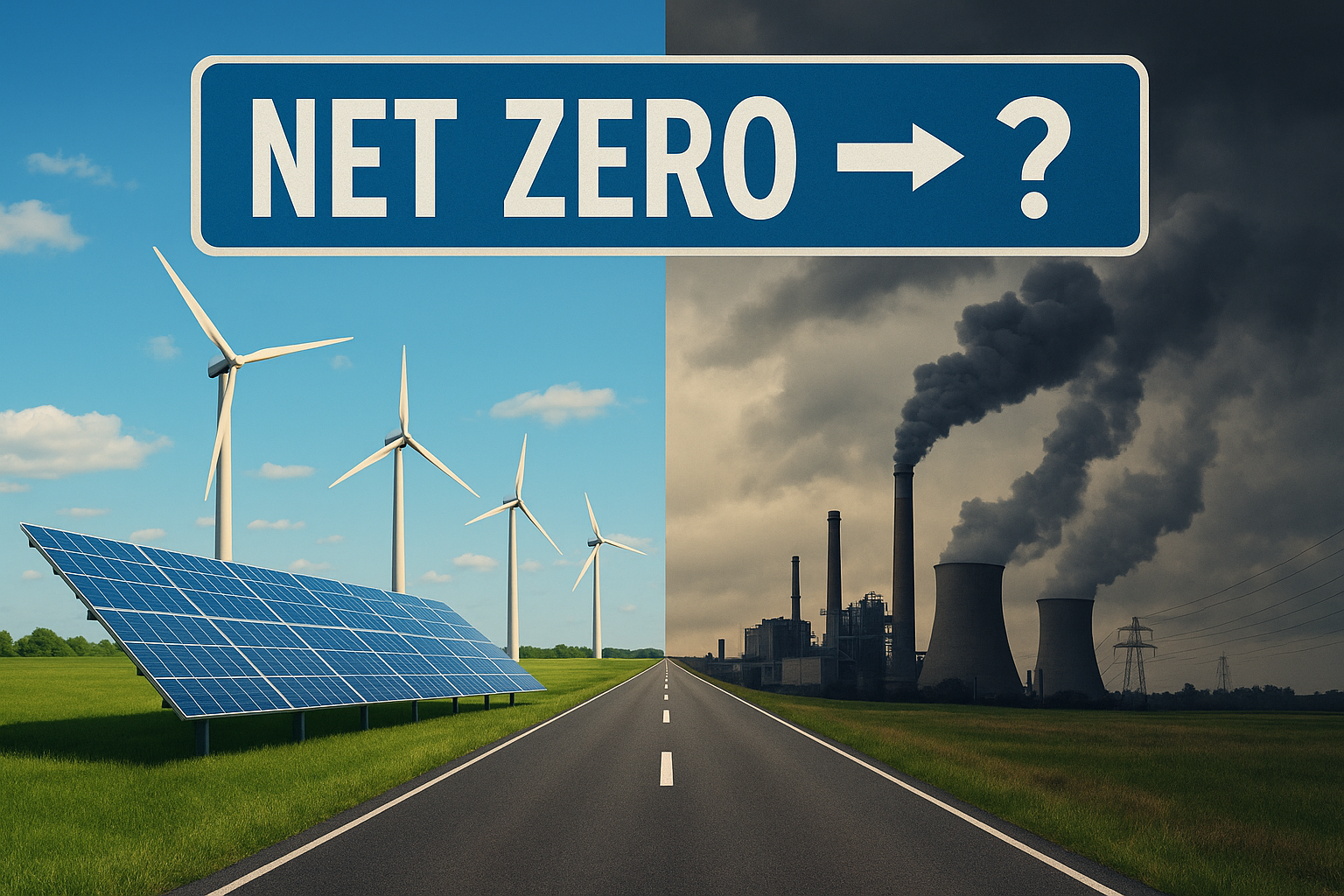

What the Liberal Party’s Net Zero Backflip Means for Australian Households and Businesses

For more than a decade, the idea of “net zero” has shaped how Australia approaches climate goals, long-term economic planning and the national energy transition. Recently, the Liberal Party of Australia confirmed it would no longer commit to the legislated target of net zero emissions by 2050. The announcement has sparked widespread discussion across industry, households and government, prompting many to explore what this shift means in practical terms. As Australia continues navigating global energy changes, the policy reversal has become a focal point for conversations about affordability, reliability and long-term competitiveness.

What Is Net Zero and Why It Matters

Net zero refers to the point where the amount of greenhouse gases released into the atmosphere is balanced by the amount removed. This can be achieved by cutting emissions through cleaner energy, improved efficiency and technology, and by offsetting any remaining emissions through activities like carbon capture or land restoration. It matters because reaching net zero is widely viewed as essential to stabilising global temperatures over the long term. For countries like Australia, the concept shapes how industries plan investment, how energy systems evolve and how households adopt new technologies. Whether targets are strict or flexible, the idea of net zero influences economic strategy, infrastructure development and the pace of the national transition.

What the Backflip Actually Means

The policy adjustment means the Liberal Party has stepped away from its previous commitment to achieving net zero by 2050, opting instead for a more flexible, technology-led approach. According to ABC News, the updated policy supports reducing emissions “year on year” but avoids locking in a hard 2050 deadline. The shift is framed around giving industries more room to choose the most appropriate technologies while maintaining energy reliability and minimising costs for households.

Key points of the updated position include:

- No fixed commitment to net zero by 2050, though achieving it is still considered a “welcome outcome.”

- Greater focus on technological progress rather than legislated long-term targets.

- Continued involvement in the Paris Agreement, without strict interim milestones.

- Emphasis on keeping energy prices stable for Australian families and businesses.

This shift means that long-term policy signals, once clearer, now carry more uncertainty. These signals often guide investment decisions, technology adoption and the pace of national climate planning.

Why It Matters for Australian Households

1. Energy Bills and Affordability

Energy affordability is one of the central reasons cited for the policy backflip. The argument is that mandated long-term targets could raise costs, particularly if industry must meet deadlines that require large-scale, expensive transitions. However, others suggest that uncertainty can also influence bills if investment slows or becomes riskier. For households, this creates a more complex outlook for power prices over the next decade.

Potential impacts include:

- Changes to incentives for rooftop solar, batteries and energy-efficient appliances

- Altered timelines for national grid upgrades

- Shifts in energy market behaviour influenced by investor confidence

- Longer-term uncertainty in power price patterns

If grid upgrades or renewable projects slow, bill impacts may emerge later. On the other hand, accelerated adoption of certain technologies could still bring down costs over time.

2. Home Building and Renovation

Building codes and home-efficiency standards are heavily influenced by national sustainability targets. When these targets shift, the construction sector often adjusts accordingly. Homeowners planning renovations or new builds may experience different expectations around standards or recommended upgrades.

Potential implications include:

- Slower movement toward stricter energy-performance standards

- Changes in the pace of incentives for electrification or insulation upgrades

- A shift in the resale value emphasis on sustainable or energy-efficient features

3. Consumer Confidence and Long-Term Purchases

Large purchases such as electric vehicles, solar systems or efficient heating systems are influenced heavily by policy clarity. If incentives or the broader national approach feel uncertain, some households may delay decisions. This can slow the uptake of newer technologies even if they remain cost-effective in the long run.

As the policy landscape evolves, families may take a more cautious approach to high-value energy upgrades until the long-term framework becomes clearer again.

Why It Matters for Australian Businesses

1. Investment Certainty and Planning

For many businesses, especially those in manufacturing, construction and clean energy, long-term planning relies on stable, predictable policy settings. When bipartisan alignment isn’t clear, investment can feel riskier, and some companies may delay major projects while assessing future policy directions.

Businesses may now:

- Reconsider timelines for transitioning to low-emission technologies

- Adjust investment strategies for large-scale renewables or batteries

- Reevaluate risks associated with fossil-fuel-related assets

- Modify internal sustainability commitments connected to international supply chains

- Update long-term financial models based on changing policy assumptions

This does not mean investment will stop; rather, it may shift in timing or be approached with increased caution.

2. Impacts on Industry Sectors

Different industries are affected differently:

Construction:

Builders rely on predictable standards to design and deliver efficient homes and commercial buildings. When future targets are unclear, demand for advanced materials or high-efficiency construction methods may change.

Renewable Energy:

Renewable energy developers need confidence in long-term policy settings to secure financing. A more flexible approach can create uncertainty for wind, solar and emerging hydrogen projects.

Energy Utilities:

Electricity networks plan infrastructure upgrades many years in advance. Changes to long-term targets can influence how quickly storage, transmission lines or regional upgrades roll out.

Manufacturing:

Manufacturers that have aligned with global supply-chain requirements or emissions expectations may now need to rethink their strategies or reassess future commitments.

3. Business Costs and Customer Behaviour

Shifts in customer behaviour can affect sectors ranging from home services to appliance retail to electric vehicle suppliers. If consumers hesitate to make major energy-related purchases, businesses may need to adjust pricing strategies, inventory or marketing.

Operational costs can also shift for businesses if energy markets adapt differently based on changing investment patterns or technology uptake.

What These Changes Don’t Mean

While the backflip is significant, several misconceptions often arise:

- Australia is not withdrawing from the Paris Agreement.

- Emissions-reduction efforts are not stopping; the approach is changing, not the intent.

- Energy prices will not automatically change because many other factors influence them, including global fuel markets and infrastructure investment levels.

- Businesses and households can still pursue energy-efficient upgrades regardless of national policy settings.

The shift represents a change in direction, not an abandonment of climate or energy progress.

What to Watch Going Forward

Understanding the practical implications will require monitoring several developments:

- How the Coalition shapes its final climate and energy framework

The specific details will influence how businesses and households respond. - Industry investment announcements

Renewable energy projects, grid upgrades and major construction plans will signal confidence levels. - Energy market behaviour and bill trends

Fluctuations in pricing, availability and reliability will offer clues about the long-term impacts. - State-level policies

State governments may continue pursuing their own targets, creating varied standards nationwide. - International investment activity

Australia’s policy direction may influence how global investors view local projects, especially in manufacturing and energy.

Conclusion

The Liberal Party’s decision to move away from a firm net-zero-by-2050 commitment marks a pivotal shift in Australia’s climate and energy policy landscape. Households may face new uncertainties around energy bills, home upgrades and long-term purchase planning. Businesses, particularly those influenced by energy, construction and manufacturing trends, may revisit investments, strategies and risk assessments.

Although the approach has changed, emissions-reduction efforts continue to matter across many sectors. As further announcements unfold and industry responses become clearer, Australians will be able to better understand how the policy shift shapes the nation’s energy future, economic direction and long-term sustainability ambitions.

FAQs

Q1. What does “net zero by 2050” mean?

It refers to balancing greenhouse gas emissions with an equal amount removed from the atmosphere so that total net emissions equal zero.

Q2. Why did the Liberal Party reverse its net-zero commitment?

The party stated that concerns about energy affordability, flexibility in technology adoption and the economic impacts of long-term targets were key reasons for the policy change.

Q3. Will energy bills rise or fall because of this change?

There is no automatic effect. Energy prices depend on factors like global markets, infrastructure investment, and the pace of technology adoption.

Q4. Does Australia still have a national net-zero target if one major party steps away from it?

Yes. The legislated national target for net zero by 2050 remains in place unless changed by Parliament. The policy shift affects the opposition’s stance, not the existing law. However, differing political positions can influence how future policies or investment signals may evolve.

Q5. Will this policy change affect incentives for solar, batteries or home-efficiency upgrades?

In the short term, most existing incentives continue unchanged because many are state-based or follow separate regulatory processes. Over time, the pace and design of federal incentives could shift depending on broader policy directions and future updates.

Q6. How might the backflip influence business investment decisions?

Many businesses, especially in energy and construction, plan investments years in advance. When long-term targets become less certain, some companies may delay or adjust major commitments until the policy environment stabilises, particularly for large infrastructure or technology projects.

Q7. Does the net-zero backflip affect Australia’s participation in international climate agreements?

No. Australia remains part of the Paris Agreement unless a future government chooses to withdraw, which is unlikely. The policy shift affects domestic targets and planning, not international membership.

You must be logged in to post a comment Login