Misc

Cash vs Digital Payments: Australia’s Surprising Twist in the Race to Go Cashless

In an age dominated by digital wallets, tap-and-go payments, and the rise of instant banking apps, it seems like cash is quickly becoming a relic of the past. Yet behind the scenes, there’s a growing debate playing out in banks, parliament, and communities across Australia — one that’s about more than just convenience. What if cash still holds critical value in our increasingly digital world? What if walking away from it too quickly risks leaving people behind?

That question has sparked renewed interest after one of Australia’s biggest banks made a move that surprised many. While much of the country is charging toward a cashless future, the Commonwealth Bank has chosen a different path — one that’s challenging assumptions about how we pay, who gets left out, and what financial freedom really means.

To understand what’s at stake in the ongoing cash vs digital payments debate, we need to look at the evolution of payments in Australia, the latest usage data, and what this all means for the future of money.

The Digital Payment Boom in Australia

Australia is among the leading nations when it comes to adopting digital payments. The rise of mobile banking apps, QR code-based payments, and platforms like Apple Pay and Google Wallet has transformed how Australians transact.

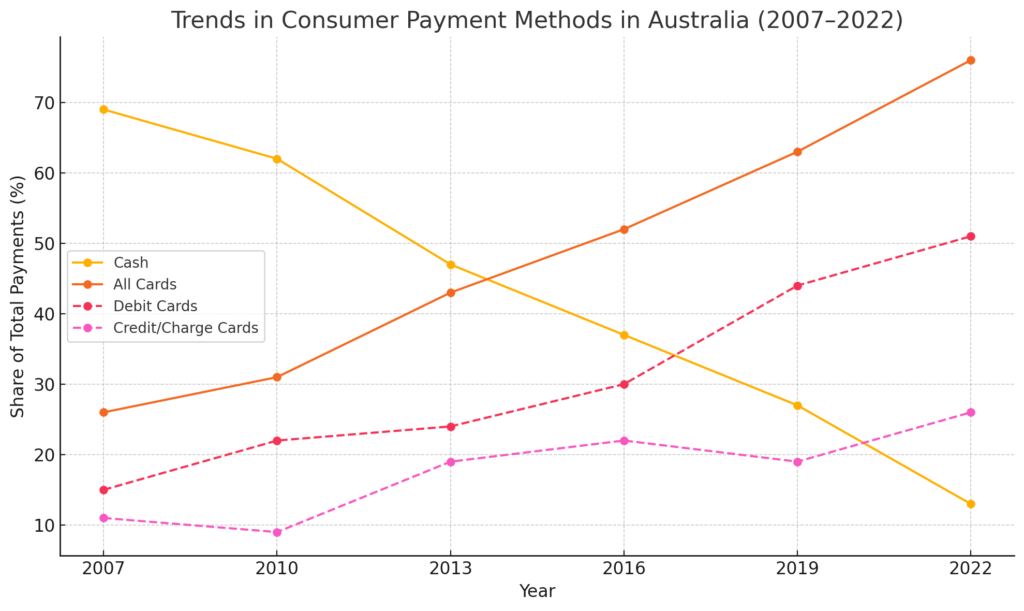

According to the Reserve Bank of Australia (RBA), cash was used in only 13% of all transactions in 2022, down from 69% in 2007. Moreover, 93% of Australians now own a debit or credit card, and the adoption of smartphones for banking and purchases continues to grow.

The rise of the New Payments Platform (NPP), which enables real-time transactions via PayID, has also accelerated the shift. Australians sent over 1.1 billion NPP payments in 2022 alone, highlighting a nationwide appetite for fast, digital transactions.

Commonwealth Bank’s Position: Cash Still Matters

While most banks continue scaling back physical banking infrastructure, the Commonwealth Bank of Australia (CBA) is taking a different route. At its 2025 Annual General Meeting, held on 15 October in Brisbane, Chairman Paul O’Malley directly addressed growing concerns over the future of cash.

When asked whether CBA planned to go fully digital and eliminate cash services at branches and ATMs, O’Malley firmly rejected the notion:

“I think cash is still absolutely critical.”

He noted that the bank is investing heavily to maintain cash availability and is actively working with other industry players to ensure that access to cash remains viable — especially for customers in regional areas and for those who prefer or depend on physical money.

This reassurance comes amid mounting pressure over the rapid decline in bank branches and ATMs across Australia. APRA data shows the number of bank-owned ATMs has fallen from 13,814 in 2017 to 5143 in 2025, and the number of regional branches has nearly halved in the same period.

Public response has been significant. Advocacy group Cash Welcome, led by Jason Bryce, launched a petition demanding a national “banking cash guarantee.” The petition calls for Australians to have local access to cash and full banking services — and it’s already garnered over 215,000 signatures.

By publicly reinforcing its cash commitment, CBA is positioning itself as a bank that supports not just innovation, but also inclusion — recognising that millions of Australians aren’t ready, or able, to go fully digital.

Why Cash Still Has a Role

Despite its decline, cash remains vital for several reasons:

1. Resilience in Emergencies

Digital systems can fail. Whether it’s natural disasters, cyberattacks, or power outages, cash provides a reliable backup. During the 2022 Lismore floods, for example, EFTPOS machines went offline, and cash became essential for survival.

2. Financial Inclusion

Not everyone has equal access to digital tools. According to the Australian Digital Inclusion Index 2023, roughly 11% of Australians remain digitally excluded — due to age, income, geography, or lack of digital skills.

3. Privacy and Autonomy

Cash offers anonymity. For individuals concerned about data tracking or surveillance, physical money provides a private way to transact — a right increasingly valued in a data-driven world.

4. Cultural and Psychological Comfort

Some people simply prefer cash. It helps with budgeting, feels more tangible, and carries fewer perceived risks of fraud or over-spending.

Historical Context: Australia’s Relationship with Cash

Australia’s journey with physical money has been marked by innovation and adaptation. In 1966, the country transitioned from pounds, shillings, and pence to the Australian dollar, introducing a new era in monetary handling. Over the decades, the nation also led globally with the introduction of polymer banknotes in 1988 — a move that significantly enhanced the durability and security of currency, and which has since been adopted worldwide.

Cash has long played a central role in both everyday commerce and crisis scenarios. From markets and roadside stalls to remote communities where digital infrastructure is limited, physical money has ensured inclusion and access.

Even as digital systems rose in the 2000s and 2010s — particularly with the spread of EFTPOS and contactless cards — cash remained a fallback in times of emergency. Events like the 2016 nationwide EFTPOS outage and natural disasters have repeatedly demonstrated the need for resilient, offline-compatible payment methods.

The Reserve Bank of Australia explored these changes in-depth in their 2021 bulletin on the future of cash, highlighting both the rapid decline in cash use and the reasons it’s still essential.

Yet, despite predictions of a cashless society, physical currency persists.

The Rural and Regional Divide

A key factor in CBA’s stance is the digital divide. In metro areas, going cashless may feel like progress. But in rural and remote regions, limited internet access, fewer bank branches, and poor mobile coverage make digital-only solutions risky.

The RBA has also acknowledged that ATMs and bank branches are closing faster in rural areas, leading to reduced financial access for many communities. Maintaining cash services helps ensure inclusivity.

Global Comparisons

Countries like Sweden and South Korea are further ahead in going cashless — yet both have faced pushback. In Sweden, elderly citizens and rural communities prompted new laws requiring banks to provide cash services.

In the U.S., some cities like San Francisco and New York have banned cashless-only businesses, citing discrimination against the unbanked.

Australia may be moving fast toward digital, but the global lesson is clear: total exclusion of cash can lead to social and economic inequality.

Balancing Progress with Inclusion

CBA’s position highlights a broader need for balance. Supporting digital growth shouldn’t come at the cost of leaving behind vulnerable populations. A dual-payment system — where both digital and cash coexist — appears to be the most equitable model for now.

As fintech innovation continues, financial institutions must design systems that are inclusive, secure, and resilient. CBA’s continued cash support sends a signal that Australia can lead not only in technology but also in thoughtful, inclusive finance.

Conclusion: Is Cash Still King?

Maybe not — but it’s not obsolete either. In a fast-moving digital economy, cash still serves a purpose, especially for the marginalised, the cautious, and in moments of crisis. The Commonwealth Bank’s decision to support both ends of the spectrum may prove not just popular, but essential.

As Australia evolves into a predominantly digital society, retaining a cash option ensures that financial freedom and access remain available to all — not just the digitally fluent.

You must be logged in to post a comment Login